22.10.2024

The gentleman’s guide to gold investment in Malaysia

Discover why discerning Malaysian gentlemen should consider gold in their investment portfolios. Explore physical and paper gold options, and learn how this timeless asset complements stocks, ASB, and cryptocurrency for long-term wealth preservation.

By Raja Izz, MBA

Photo by Daniel Zuchnik/WWD via Getty Images.

Disclaimer: This article is for educational purposes only and should not be considered financial advice.

In an age where cryptocurrency headlines dominate financial news and traditional investments like Amanah Saham Bumiputera (ASB) remain a steady comfort, the discerning Malaysian gentleman might wonder: why consider gold? The answer lies not in trends or tradition alone, but in the timeless wisdom of true portfolio diversification.

The Golden Advantage: Why Every Man Should Consider Gold

Picture this: while your stocks ride the volatile waves of market sentiment, and your ASB provides steady, predictable returns, gold sits in your portfolio like a distinguished guest at a high-stakes poker table – unperturbed by the chaos around it. This precious metal has weathered centuries of economic storms, outlasting empires and currencies alike.

The modern gentleman's portfolio often includes a mix of stocks, ASB, and perhaps a dash of cryptocurrency for contemporary flair. Yet, gold offers something unique – a tangible hedge against the intangible uncertainties of our times. While cryptocurrencies promise the future and stocks reflect the present, gold carries the wisdom of the past.

Choosing Your Path: Physical or Paper Gold

The journey into gold investment presents two distinct paths, each with its own elegant appeal. Physical gold, whether in bars or coins, offers the tactile satisfaction that digital assets cannot match. There's an undeniable allure in holding a gold bar, knowing it represents real value that has endured through millennia. For the gentleman who appreciates the finer things in life, physical gold resonates with the same philosophy that might lead one to collect vintage watches or classic cars.

Paper gold, on the other hand, caters to the modern gentleman who values convenience and liquidity. Through Malaysia's premier banking institutions, investors can now participate in the gold market without worrying about storage or security. Think of it as having a wine collection managed by a prestigious vineyard – you own the asset without the complexities of physical maintenance.

Malaysia's Golden Gateways: Where to Invest

In Malaysia, three distinguished institutions stand out in the gold investment landscape:

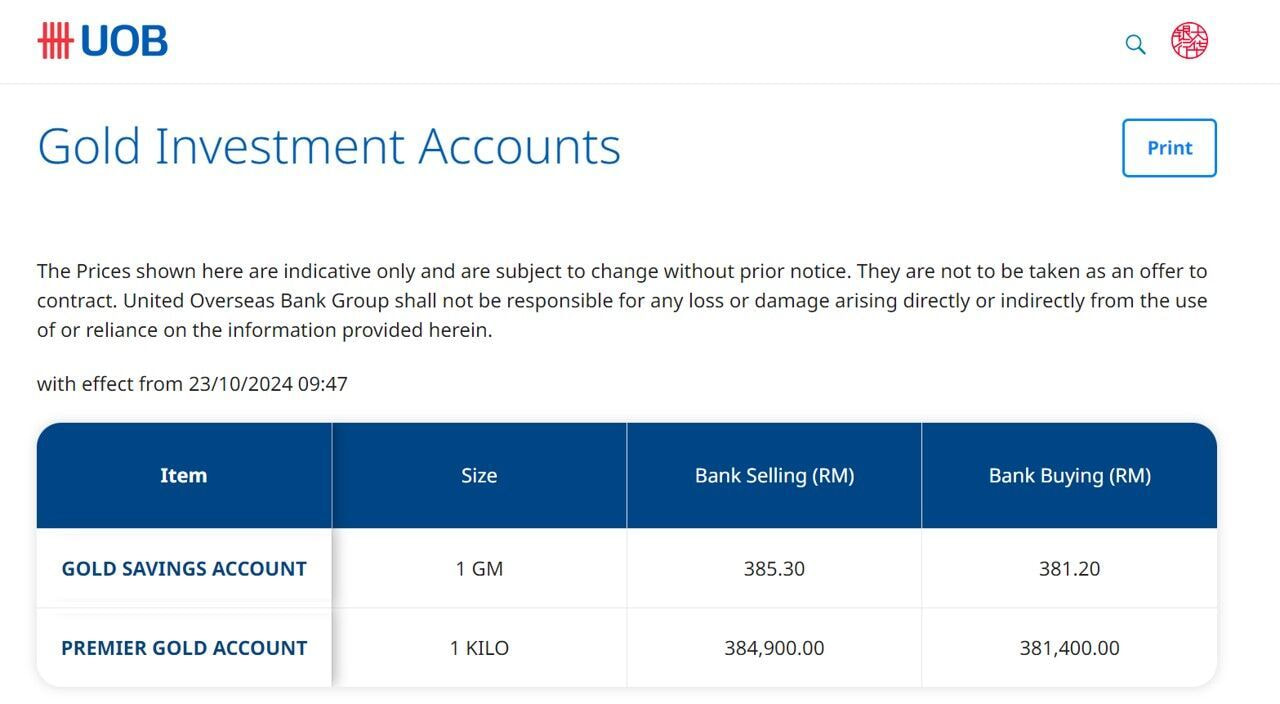

1. UOB Bank

2. Maybank

3. Public Bank

1. UOB's Gold Investment Account