21.05.2025

How smart men go broke: Liquor, Ladies, and Leverage

Charlie Munger once said smart men go broke three ways: liquor, ladies, and leverage. We unpacks this timeless warning with wit, real-life stories, and modern wisdom every gentleman needs.

Words: Johan Chua

James Bond: No Time to Die

Metro Goldwyn Mayer Pictures via AP

DISCLAIMER:

At GC, we honour the diverse values and beliefs of our global readers. The following article explores themes that include alcohol and certain lifestyle choices, referenced purely for financial, cultural, and cautionary insight. These references do not reflect an endorsement, and we encourage readers to interpret them within the context of their own principles and values.

If Charlie Munger - the late vice-chairman of Berkshire Hathaway and arguably one of the wisest investors of all time - drops a truth bomb, you’d be a fool not to listen. And one of his most infamous quips?

“Smart men go broke three ways: liquor, ladies, and leverage.”

It’s humorous. It’s sharp. And tragically, it’s true.

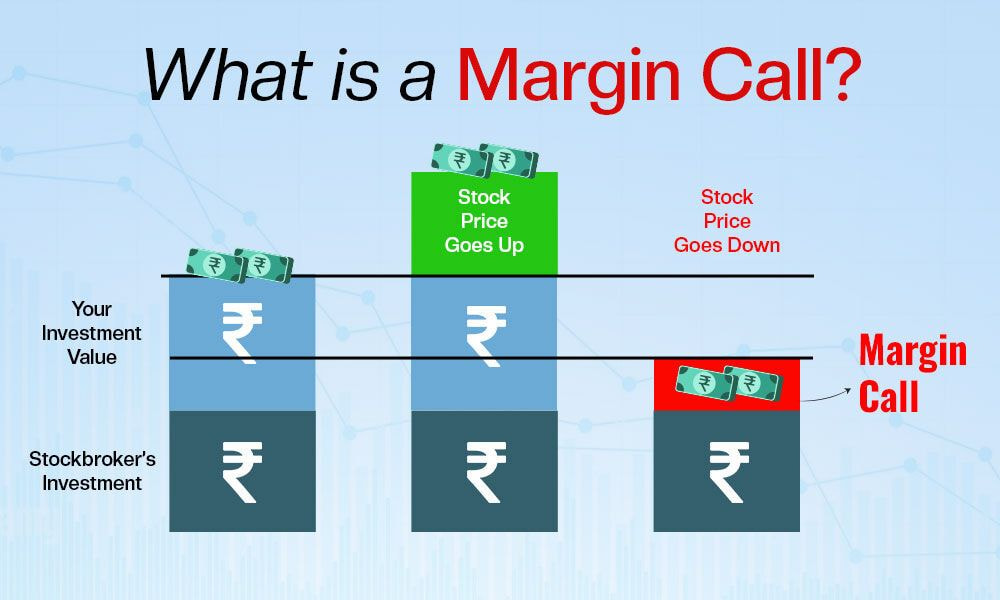

Let’s break this down, one dangerous indulgence at a time. Whether you’re in Kuala Lumpur’s rooftop bars, London’s Mayfair clubs, or Istanbul’s crypto lounges, these three Ls have been known to turn rising stars into cautionary tales. Here’s your stylish survival guide.