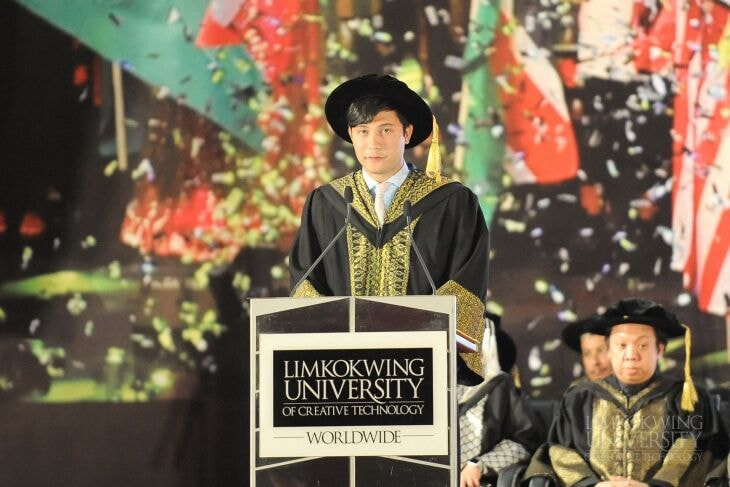

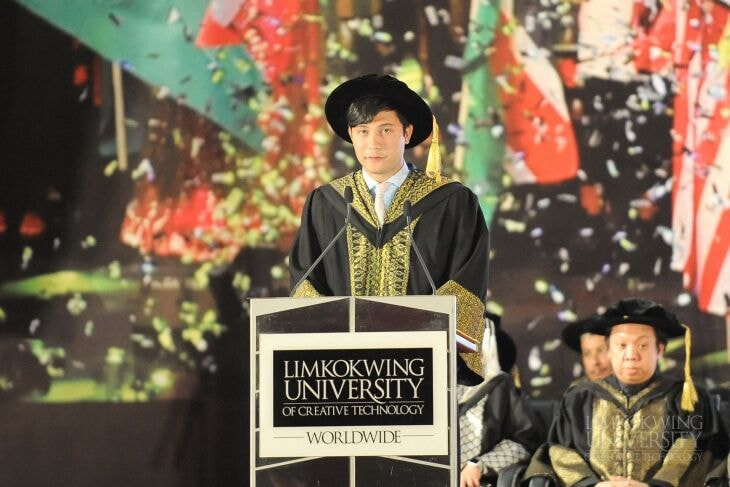

Photo: Ahmad Zulqarnain Onn, Chief Executive Officer of the Employees Provident Fund (EPF)

Those are the fundamentals. The reasons New Money drops the ball are legion. As I’ve said before, New Money parents may be so focused on giving their children what they never had that they forget to give their children what they did have: namely, a challenge, motivation, and an opportunity to success and fail. It’s also important that the parents get a firm grip and new perspective on what role money plays in the life of the family. You have to know what money can and can’t do for you. And you have to have a sense of who you are outside your financial net worth. Tricky business when you’ve gone from rags to riches, or, more likely, working class to rich in a matter of just a few years.

To preserve wealth, my opinion is that you’ve got to first drill into your children’s heads the Core Values I detail in The Old Money Book. Not a delicate way to put it, but perhaps the imagery will help with the execution. (Wink, nod.) Second, you’ve got to structure you finances with wills, trusts, insurance, etc. to ensure the smooth transfer of wealth from one generation to the next (minimizing taxes and family feuds is key). Third, you’ve got to clearly articulate, while you are alive and healthy, what you expect your heirs to do with the money once you’re gone. That is, they are to preserve it and make it grow in order to provide security, health, education, and opportunity for themselves and generations to come. This is the long view, and they need to adopt it early on. Finally, it helps to have a CPA, family attorney, and perhaps an investment advisor who can ‘circle the wagons’ when the time comes and keep things on an even keel.

I hope this provides an overview of Old Money’s attitudes and protocols for the preservation of family wealth. It’s been suggested that I provide a consulting service for New Money, but I’m sure I’d get too angry when I gave advice and people didn’t listen.

So I’ll just stick to writing.