18.10.2024

5 investment lessons from the best investing books of all time

Unlock the secrets to financial mastery with five essential lessons from legendary investors like Warren Buffett and Charlie Munger. Learn strategies for wealth, influence, and long-term success.

By Raja Izz, MBA

Pictures by Getty.

Picture this: You're standing in your study, swirling a glass of 18-year-old Macallan, gazing out at the city skyline. You've worked hard to get here, but you can't shake the feeling that true financial mastery still eludes you. Sound familiar, gentlemen?

We've all been there. The world of high finance can seem like an exclusive club, its doors guarded by Wall Street titans and Silicon Valley wunderkinds. But here's a secret: the path to wealth and power isn't as mysterious as they'd have you believe.

As someone who has first-hand serving in one of Malaysia's august investment institutions, I've pored over the wisdom of financial greats, seeking the keys to their kingdoms. What I've discovered is that building an empire isn't about flashy trades or insider tips—it's about adopting the mindset and strategies of those who've already conquered the financial world.

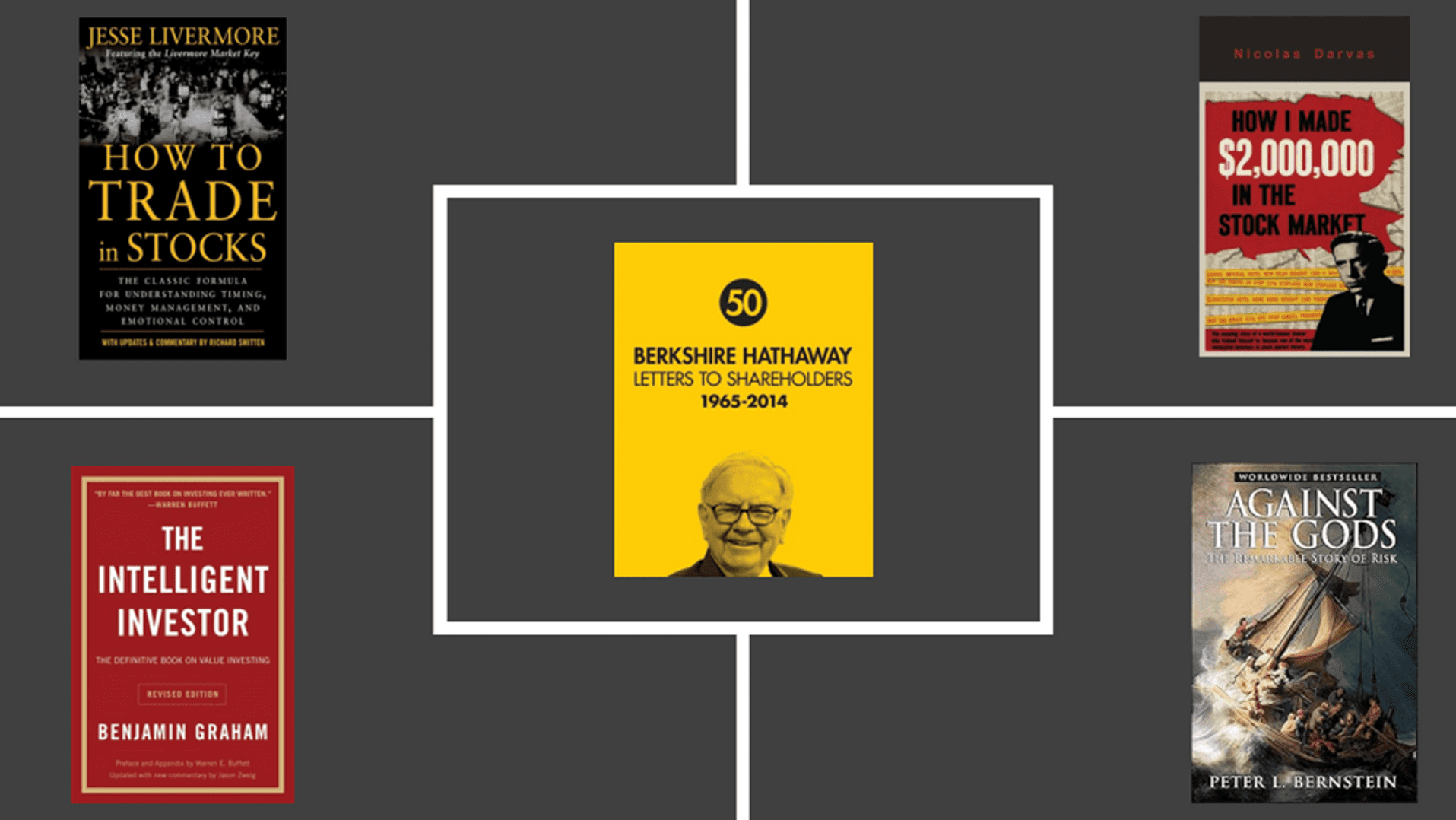

In this article, we'll explore five essential lessons drawn from the most influential investing books of our time. These aren't just dry financial concepts; they're the very principles that have shaped the fortunes of men like Warren Buffett, Charlie Munger, and Benjamin Graham. By the time you finish reading, you'll have a roadmap to not just grow your wealth, but to cultivate the power and influence that comes with true financial mastery.

So, refill that glass, gentlemen. It's time to elevate your financial game and set yourself on the path to becoming not just wealthy, but a true titan of industry.

The following five lessons from the best investing books.